Stand Up for Borrower Defense

Holding schools accountable, protecting students from fraud, and preventing abuse of the federal loan system

What is Borrower Defense?

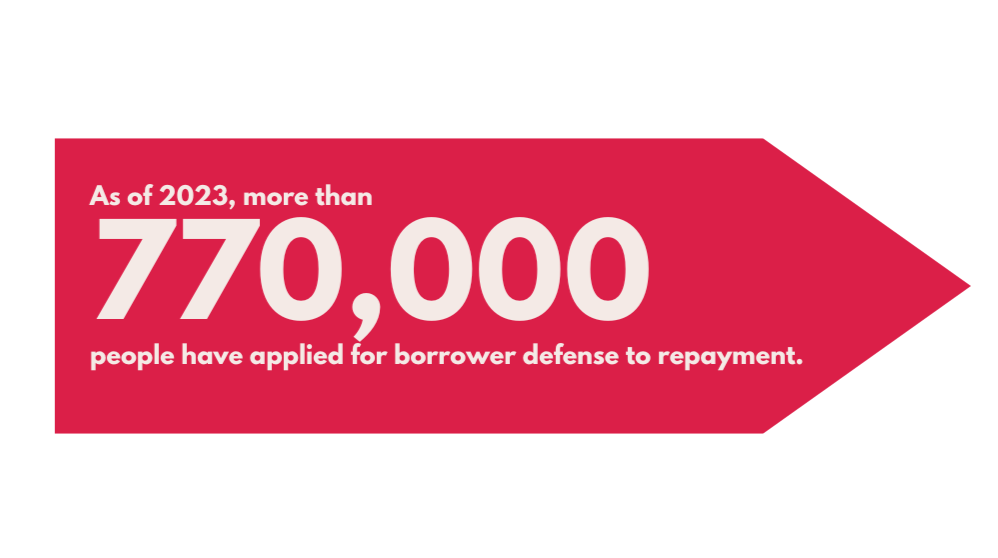

Borrower defense to repayment is the provision in law that federal student loan borrowers should not be forced to repay loans for classes or degrees from schools that have lied to, deceived, or misled them.It is also a critical protection for taxpayer investments, limiting the fraud and abuse that runs rampant in higher education as colleges seek to profit off the student loan system. Learn more about why we need to stand up for borrower defense.

Know the Facts

More From Borrowers

More from Beth K. (North Carolina)

Debt is a vicious cycle. The school I went to defrauded me and I got in way over my head to pay their tuition. It was the only option I saw so I signed up. Soon after, I got divorced and became a single mom. That was 15 years ago. I could never get out of the debt hole cycle completely. In order to pay for my loans, I had to charge basic necessities like groceries and clothing for my son. This incurred high interest and everything spiraled. I am doing better now but still have no savings and most months still had to charge for some basic needs. With the federal student loans off my credit report and without this monthly payment, I can better support my son and me without credit cards. This changed my life and I feel like I can breathe again.

Christopher F. (Texas)

These loans were predatory. Even when my loans were garnished for many years I was compounded repeatedly and even making payments it was barely a drop in the hat. Getting an education in this country should not cost someone an arm and leg.

Nina M. (South Carolina)

I won't have to shake my head in disappointed when I check my credit report seeing the over $50,000 on my credit report for a 2yr associate degree. I feel like I have a chance to start my life all over.

Anna Moore (Oklahoma)

Having the debt hanging over our heads with a useless degree is much more detrimental to us than most people think. Having had to pay almost DOUBLE if not TRIPLE what normal people pay for degrees to attend an online university then find out they offer non job placement and they are not accredited and I cannot use my degree to get my bachelor's and I would have to start all over is heartbreaking mentally and financially.

Bythe TwoSisters (Texas)

For me, I was sold a lie and worked really hard to be an excellent medical provider in the behavioral health sector and cannot get out from under the massive student loans it took to achieve as the school continued to lie to me as a student. By the time I figured out they were lying on many levels, I felt too far into the program to leave with a huge bill and no degree to help me bail myself out. The degree has not proven to be what it needs to be to financially recover.

Aaron Sibold (Kansas)

Not all schools have the best interest of students. Some are out doing predatory practices and feeding off the undereducated and vulnerable individuals. By doing this, schools should be held liable for this gross practice. It should not be on the victim to have to suffer the consequences by being mistreated by some institute. The institutes are using manipulation and getting away with it. And they are not being held accountable. I finished my degree at a University that truly cared about their students and their success. It was night and day compared to the predatory school I previous attended, DeVry.

David G. (Ohio)

For years, we were told that a college degree was the only way to succeed in life. We believed this and took out large loans to invest in what we thought was our future.

But instead of delivering on their promises, they preyed on us. They exaggerated job placement rates and the value of their degrees, leaving many of us with massive debt and few opportunities. We're now worse off than before we enrolled, struggling under the weight of loans we can't repay. This debt isn't just a financial issue, it's preventing us from building stable, fulfilling lives. We can't buy homes, start families, or invest in our futures. It's a barrier to the American Dream that we were promised.

We need accountability for predatory schools and relief for borrowers who were deceived. Without meaningful action, this crisis will continue to devastate lives and limit opportunities for generations to come. The system is broken and disproportionately harms vulnerable borrowers. We trusted schools that claimed to set us up for success, only to end up much worse off.

Borrower Defense Resources

Learn the Details

Third Way: Trump's Red State Higher Ed Dilemma

PPSL: FAQs on Borrower Defense

NAICU: Borrower Defense Issue Brief

NASFAA: Borrower Defense Web Center

In the News

This website was paid for by Third Way in partnership with the Project on Predatory Student Lending.